-

Home

-

Live

-

Home and Property

-

Your rates

- Rates FAQ

Rates FAQ

You’ll find on this page:

Rates are an important source of income for Council and are used to deliver services, maintain community infrastructure and provide new projects and services.

Rates are made up of both a fixed charge component and a variable charge:

- The fixed charge is calculated based on 50% of rate revenue and is the same for all ratepayers.

- The variable charge is calculated as a rate in the dollar and applied to rateable capital values. A number of factors inform the calculation of the variable charge, including land use, or the capital value of the property.

2025/26 Rates

Each year, Council prepares an Annual Business Plan and Budget (ABP) which outlines the services, projects and programs Council will deliver in the year ahead. It includes how we will fund ongoing services and inflationary costs to deliver day-to-day operations, as well as how we will fund new services and assets and cost pressures.

- The City of Playford Annual Business Plan and Budget is based on a 4.54% increase in rate revenue for the year, which will add $1.83 per week to the average rates bill in Playford.

- The impact for individual ratepayers will vary depending on the movement in the capital value of your property.

- Rates are an important source of income.

- The increase funds new projects and services the community has asked for.

- We are focussed on delivering new projects and services that meet our strategic objectives.

- It also covers rising costs and meets budget goals that support long term financial sustainability.

The 2025/26 budget continues to deliver the services and projects that support our diverse and growing community.

25 core services, over 200 activities

The majority of the budget is allocated to those things we know impact our residents’ everyday lives, such as maintenance of streets, verges, ovals and playgrounds, waste collection and providing libraries and community centres. These services are the backbone of our city, and account for the majority of Council’s budget, with $125M allocated to this work.

Supporting growth

On average, 10 additional people a day are forecast to move to Playford over the next 20 years, making our city one of the fastest growing areas in the state. We will continue to invest in projects that support our growing areas to be functional, liveable and connected to the established areas of our city.

Managing and maintaining assets

$38.4M will be invested in asset renewal, ensuring the things you use every day, like roads, footpaths and playgrounds remain in good condition.

- Council provides a broad range of services across the whole of the city. There are ongoing initiatives and activities available to all residents, even if they’re not always visible in your neighbourhood. For example:

- We provide community facilities like libraries, the Grenville Hub, Elizabeth Rise Community Centre and The Precinct Community.

- Business support services are provided through The Stretton Centre

- Council provides access to sport and recreation facilities to support health and active lifestyles as well as the opportunity for people to participate in the sports they love.

- We build and maintain playgrounds for families to socialise and connect.

- Verges, reserves and streets and roads are maintained to support a safe and connected city.

- We prioritise services that keep our community safe such as food and environmental health, immunisations, development planning, stormwater and waste management.

- Annually, we look to the projects which we know will continues to maintain and improve the current community assets, as well as support growth in our community.

- The Annual Business Plan & Budget includes suburb maps showing the locations of all new and continuing projects. See Appendix 1.

- Waste

- License Fees

- Superannuation Guarantee Charge

- Contracted prices and subscription fees

Rate Component | 2025/26 |

General rate in the dollar | $0.00134944 |

Commercial rate in the dollar | $0.01054142 |

Fixed Charge | $1,248.50 |

Regional Landscape Levy (rate in the dollar) | $0.00005715 |

General Rates

Council goes through a rigorous process to calculate rates each year. To understand this process, information outlining rates and how they are determined is in our Annual Business Plan and Budget.

Council allocates the portion of the budget to be raised from rates across all properties, adopting a fixed charge component (which in total equates to 50 per cent of all rate revenue raised) in addition to a variable charge component (calculated as a rate in the dollar applied to property capital values). The effect is that the total rates paid by the community will equal the amount set in the budget.

Our Council Rates Calculator will also help you estimate your annual rates: Visit the Calculator by clicking this link.

Different council areas have different needs and priorities, making it hard to directly compare rates.

Every council provides different services, in different ways, to different standards. This means there are different costs required to deliver services and makes a fair and equal comparison difficult.

It is also difficult to directly compare similar priced properties across different council areas. The Capital Value of a property incorporates the value of land and improvements and takes a number of indicators into account, including location, general amenities and recent sale activity.

What this means is that a property’s land value would be different if the property was located in a different council area, so the same value property between council areas may not necessarily be a direct comparison.

The City of Playford is in the Green Adelaide Region and is required to collect the Regional Landscape Levy on behalf of the Green Adelaide Board.

The Board uses the Regional Landscape Levy to fund vital natural resource management projects including the management and protection of priority water, land, marine and biodiversity assets.

More information about the Regional Landscape Levy can be found at environment.sa.gov.au/topics/green-adelaide

Yes. Ratepayers who feel they may be eligible for a rate rebate for 2024/25 should first review the Rate Rebate Policy and Application found on our Rate Relief page. Please reach out to our Rates team on 8254 4644 if you have any further questions about rebates.

Depending on the type of rebate, applications may need to be approved by the CEO or Council.

The criteria for approving a rate rebate are focused on fairness, equity and community benefit.

Capital Value

The capital value of your property is one of the factors that informs the variable charge component of your annual council rates. Capital values are independently and objectively set by the Valuer-General of South Australia.

Yes. Your property valuation may increase or decrease each year depending on changes to your property or as a result of other market influences.

Capital values can increase for many reasons. This can include:

- Building or completing a house on a vacant block of land

- Extending your property by adding rooms, carports or pergolas

- Landscaping improvements

- Amalgamating or sub-dividing property

- General increase in valuations as a result of the Valuer-General of South Australia's revaluation

Appeals against the valuation of a property must be made through the Valuer-General in the State Valuation Office within 60 days after the date of service of the Rates Notice. Appeals can be made online via www.valuergeneral.sa.gov.au

Below are the contact details:

Address: | The State Valuation Office 101 Grenfell Street, ADELAIDE SA 5000 |

Mail: | GPO Box 1354, ADELAIDE SA 5001 |

Email: | OVGObjections@.sa.gov.au |

General/Objection Enquiries: | 1300 653 346 |

No, valuations do not determine the rates income of a council. Property valuations are used to divide the rate revenue amount among individual ratepayers, as outlined in our Annual Business Plan.

Council reviews the rate in the dollar annually to make sure that it only raises rates to match the income required, which means that Council does not benefit from valuation increases.

Your property may have a higher capital value.

Properties with a higher capital value than the average will incur a greater percentage of the rates through the variable charge. Generally under State Legislation, the higher the value of the property, the higher the rates to be paid. For example, a person with a property valued at $150,000 will contribute less than someone with a property valued at $300,000 in the same council area.

Land Use

The land use of your property is another factor that informs the variable charge component of your annual Council rates. Your land or property may be categorised as general or commercial.

You may object to the land use applied to your property within 60 days of notification.

The ratepayer must:

- Complete the Land Use Objection Form and email to Ratesassist@playford.sa.gov.au for review.

- Provide the basis for objection and details of the land use that they consider should be applied.

Council will review the objection in conjunction with the Valuer-General and notify the ratepayer of its decision. If not satisfied, the ratepayer may appeal against the Council decision to the Land and Valuation Court

Objection To Land Use V2

Rates Notices and Payments

There may be a number of reasons that you have not received a copy of your Rates Notice. This may include:

- You have changed your mailing address and Council is not aware of this change

- You have registered to receive your rates notice by email - check your inbox or spam folder

- If you have a rental property, the notice may have been sent to your property managing agent

- If you made full payment of your annual rates total, you will not be sent any further rates notices throughout the financial year

- You have recently sold a property or purchased a property

Please contact us if you think you should have received a Rates Notice.

The rates data is collected approximately two weeks before the Rates Notices are posted so any payments made during this time will not show on the notice.

If the amount due remains unpaid after the due date it will be subject to fines raised in accordance with the provisions of the Local Government Act 1999, Sect 181(8).

A statutory fine of two per cent on the unpaid quarterly amount and a further interest penalty of the prescribed percentage on any further arrears monthly will apply.

If you experience ongoing financial difficulty, please phone us on 8256 0333 to make suitable arrangements for payment of overdue amounts.

- The ownership may have changed after the Rates Notice data was collected. If the rates have not been paid the Notice should be returned to Council, otherwise you can disregard the notice.

Direct Debit

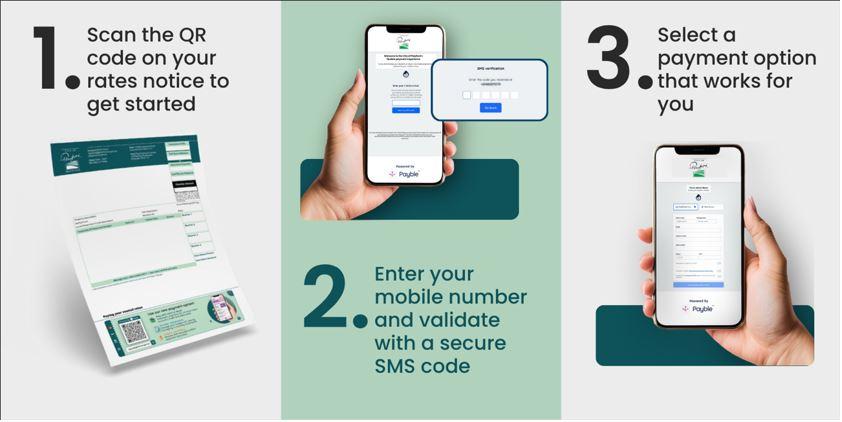

Setting up Payble is quick and easy:

1. Scan the QR code on your rates notice, or click the Set Up Your Preferred Payment Option button below

2. Enter your mobile number. You will be sent a secure SMS code number to validate your account set-up

3. Select a payment option that works for you

4. Select how you want to pay: credit card, debit card or set up a direct debit

5. Receive an SMS reminder before each payment, so you can make sure there are enough funds in your account

6. Payments will be made automatically according to the schedule of your selected payment option

Email enquiries to Directdebit@playford.sa.gov.au

Ph Rates Team 08 82544644

FAQS: HERE

Video link: HERE

Link to Set up Direct Debit/Flexible Payments: HERE

Digital Rates Notices

Once you have registered to receive digital rates notices you will no longer receive a printed copy in your letterbox.

By registering for EzyBill you will receive your rates notice via email and will have access to it on the EzyBill portal from any electronic device when you need it.

- Register with https://playford.ezybill.com.au (if you have previously registered with another Council for EzyBill, you can use the same login details).

- Once logged in, click ‘Add New’ and follow the steps to register (you will need your latest rates notice to fill in the required information).

- Keep an eye out for your next rates notice arriving in your inbox.

To view copies of rates notices online, you need to be registered for Playford Online Services and be the current ratepayer for the property.

STEP 1: View our step by step video on our Playford Online Services web page

STEP 2: Register to Playford Online Services

- Go to reportandpay.playford.sa.gov.au

- Select 'Ratepayer Registration' and follow the steps to set up your account. Remember to have your Rates Notice handy. Your Registration Name and Username ID can be found on page 2 of your rates notice. If additional login details are required, please phone Customer Contact on 8256 0333.

STEP 3: View Your Notices

To view your notices, you will first need to sign into Playford Online Services and follow the steps below:

- From the home page select 'View Rates Notices'

- On the Rates Summary screen select your Ratepayer Name highlighted in green.

- Scroll down and select 'Rates Notices'

- Select the rates notice icon to view your notice

If you have a Property Manager, your request for digital delivery of rates notices will override mail delivery to the Property Manager. We advise you to notify your Property Manager of this change.

You can only view properties if you are the current ratepayer. If you have sold a property, you will no longer be able to view rates notices for that property.

Please make sure you save any required rates notices before property settlement.

Managing Agents should contact the rates team to be provided with your Agent Code before you register with Ezybill

Register with https://playford.ezybill.com.au

Then Select Managing Agents section and add your details including your Agent Code.